Charging Ahead or Pumping the Brakes? The Real Reasons Behind America’s EV Hesitation

For the past decade, electric vehicles (EVs) were seen as the future of American mobility. Spurred by headlines about environmental urgency, innovative tech, and generous policy incentives, EVs surged from a niche product to a mainstream aspiration. Yet as 2025 unfolds, the mood is shifting: consumer sentiment is cooling, sales growth is uneven, and skepticism is rising even among former enthusiasts.

What happened? The slowdown is complex, but two core factors stand out: a lack of reliable, widespread charging infrastructure and persistently high EV costs.

A Tale of Two Markets: U.S. vs. Europe

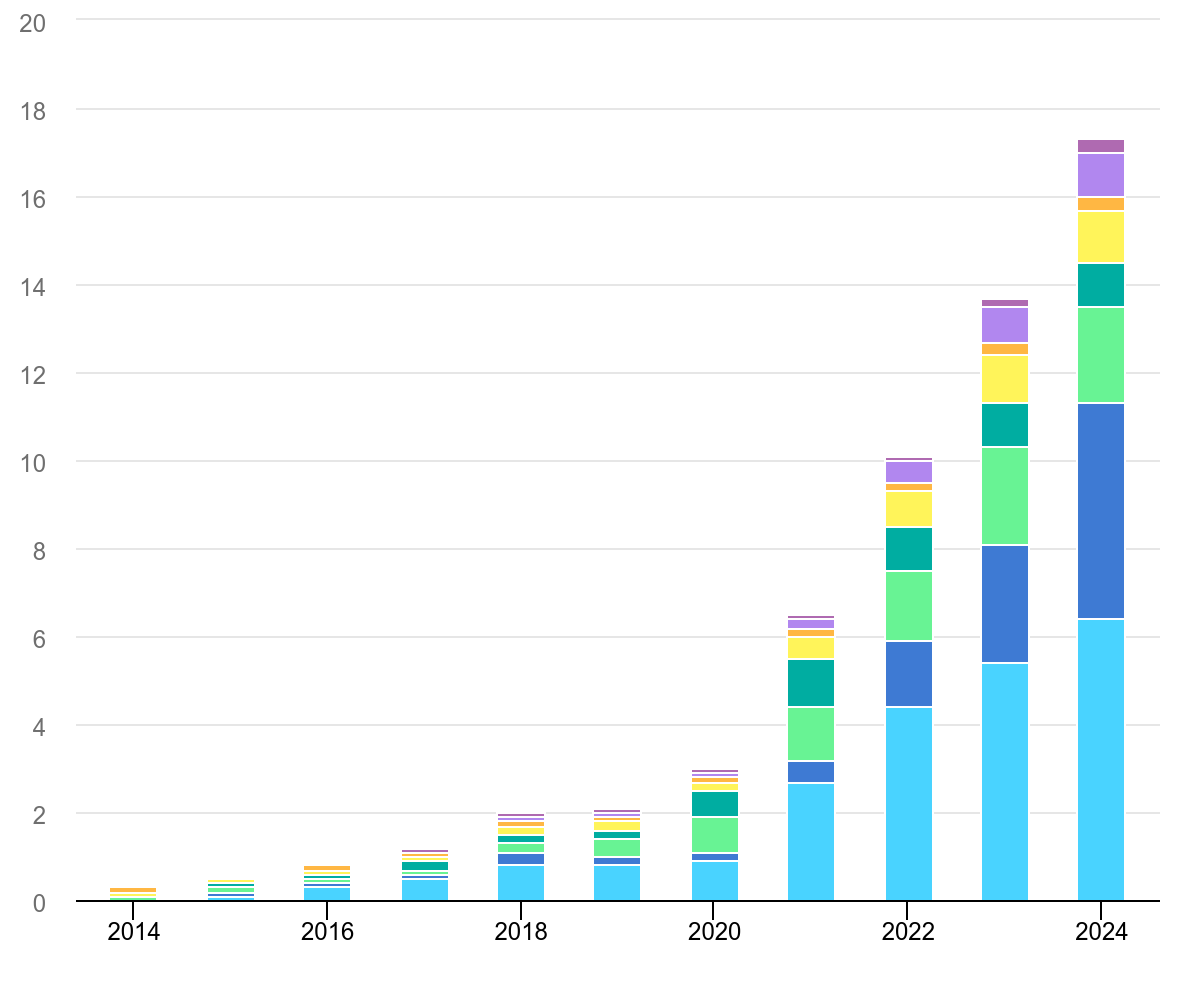

Globally, EV adoption remains robust. Over 17 million new electric cars were sold worldwide in 2024, more than 20% of all new cars (IEA, 2025). But the U.S. lags behind. In 2024, a little over 10% of new U.S. vehicles were electric, compared to over 20% in Europe and almost half of all cars sold in China (IEA, 2025).

Norway illustrates what’s possible: more than 88% of new car sales there were EVs in 2024 (Gridserve, 2025). Aggressive incentives, coupled with ample infrastructure, made Norway a model of success. In contrast, American EV adoption is patchy and uneven, with California alone accounting for over 35% of EVs on U.S. roads (AFDC, 2024).

Europe’s policy landscape also diverges sharply: a clear 2035 ban on new gasoline vehicles, stronger fuel taxes, and more consistent subsidies have created conditions for rapid EV growth. The U.S. approach has relied on carrots (tax credits, rebates) rather than sticks, leaving much of the market’s transformation to consumers themselves.

Total Global Sales by Region and Vehicle Type

The Cooling of Consumer Sentiment

The headlines suggest record EV sales, but surveys reveal the mood is cooling. According to AAA’s 2024 survey, just 18% of U.S. adults say they’re likely to buy an EV for their next car, down from 25% in 2022. Meanwhile, 63% say they’re unlikely to choose an EV (AAA, 2024).

Even more striking: about 40% of current EV owners say their next car might be a return to gasoline according to the 2024 Mobility Consumer Global Survey. After years of climbing optimism, this softening marks a pivotal shift from the early-adopter phase to the more cautious mainstream consumer.

Why the hesitation? Affordability and convenience top the list.

Infrastructure: A Chicken and Egg Problem

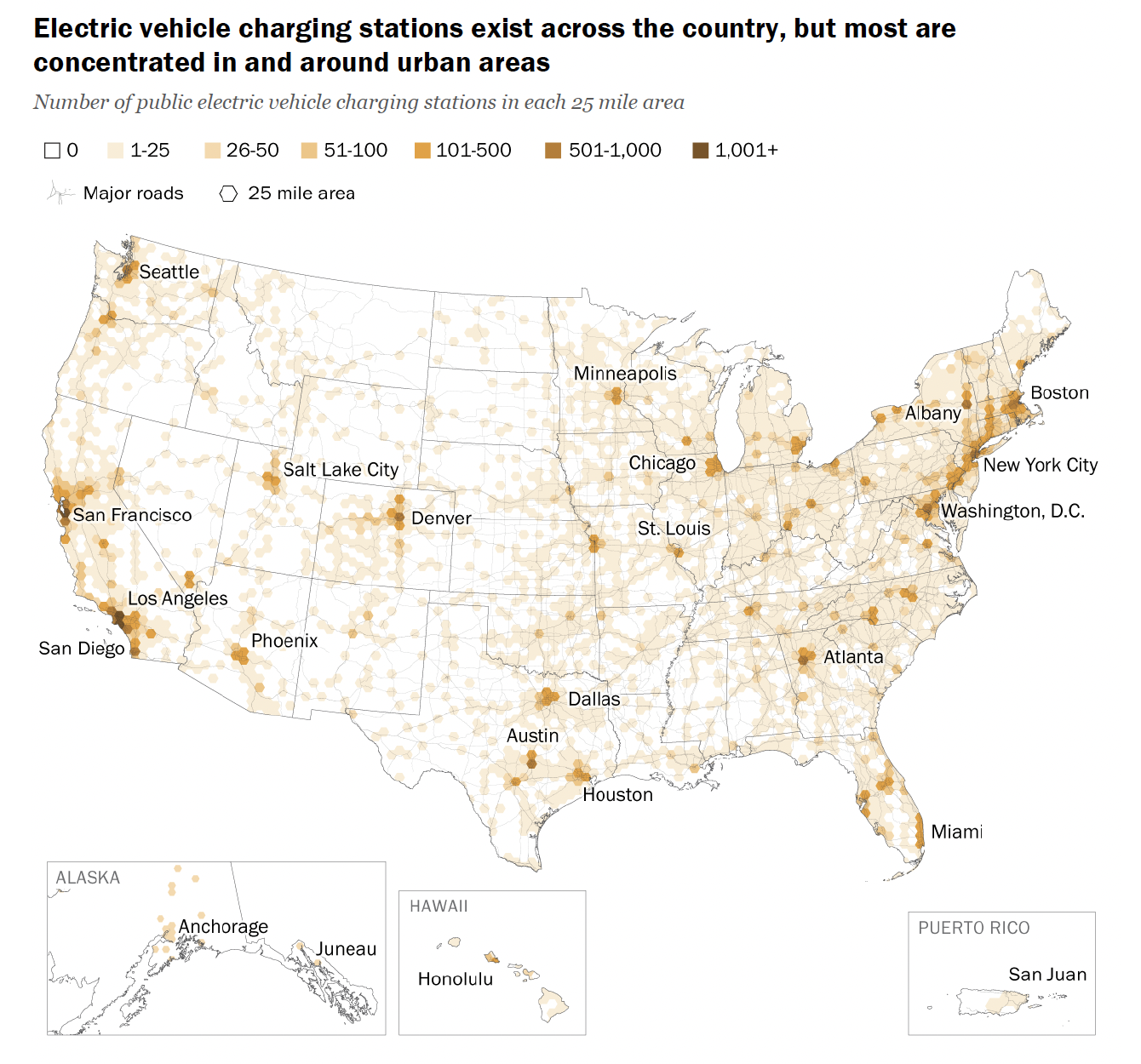

Infrastructure is the lifeblood of EV adoption, but in America, the rollout has struggled to keep pace. As of early 2024, there were about 61,000 public charging locations with over 140,000 ports (Pew, 2024). That’s a significant improvement, up 29% since the Inflation Reduction Act took effect, but still short compared to roughly 145,000 gas stations nationwide.

Urban areas fare better: 60% of urban Americans live within a mile of a charger. But only 17% of rural residents can say the same (Pew, 2024). California leads with the highest concentration of chargers but now grapples with congestion: one public charger serves roughly 29 EVs, one of the worst ratios in the nation.

In Europe and China, governments have linked EV adoption tightly with infrastructure rollout. Norway again stands out, with more chargers per capita than anywhere else. Studies confirm this correlation: adding one public charger per 1,000 people can have five times the impact on EV adoption than other factors like income or fuel prices (Iowa State Analysis, 2024).

Reliability compounds the challenge. Studies from UC Berkeley and Harvard show that charger maintenance issues, such as broken, slow, or occupied stations, erode user trust. A reliable, ubiquitous network is crucial if consumers are to treat EVs as truly convenient.

Price as a Barrier

EVs remain expensive. In 2023, the average EV in the U.S. cost about $61,000, $12k to $15k higher than the average new gasoline car (IEA, 2025). Tesla’s price cuts briefly narrowed the gap, but high interest rates have exacerbated monthly payment burdens.

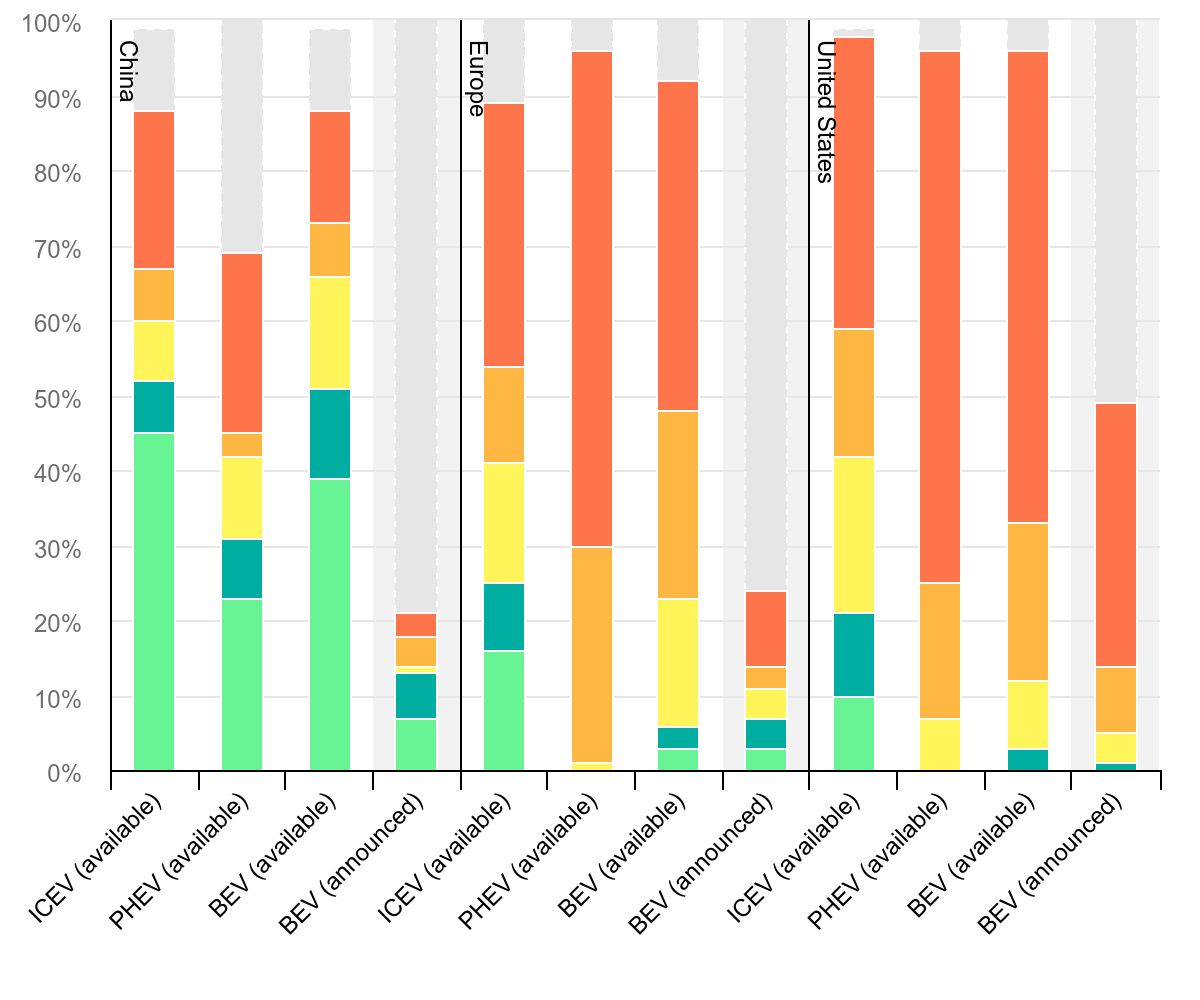

At the low end of the market, choices are scarce. Chevrolet’s Bolt EV, once the cheapest option at around $26,500, saw sales surge 63% in 2023 before being discontinued (IEA, 2025). As of 2024, fewer than 5% of EV models in Europe were priced below €25,000 (~$27,000), and the U.S. similarly lacks affordable options (IEA, 2025).

Sales Percentage by Vehicle Price

China’s experience shows affordability drives adoption. Nearly 40% of Chinese EV models cost under $25,000, and China’s median EV price (~$24k) is slightly lower than the median price of a gasoline car (IEA, 2025). By contrast, the American market has focused on premium EVs, luxury SUVs, pickups, and high-tech sedans, that cater to affluent buyers but leave mainstream consumers priced out.

Spotlight: Slate Auto’s Bold Bet

Slate Auto, a startup backed by Jeff Bezos, is testing a radical idea: an affordable electric pickup truck starting at around $25,000 (~$20,000 after tax credits). The Slate Truck’s modular design allows it to transform from a pickup to an SUV via add-on kits (TechCrunch, 2025). This flexibility lowers manufacturing costs and could appeal to middle-income buyers and tradespeople priced out of current EV offerings.

Slate’s value proposition directly addresses two hurdles: affordability and utility. Trucks dominate American vehicle sales, yet EV pickups today like the Ford Lightning, Tesla Cybertruck or Rivian R1T sit firmly in the $50k+ range.

Still, skepticism remains. Can Slate deliver a reliable product at scale by 2026? And will battery costs decline fast enough to make a $25k truck profitable? Industry history is littered with failed startups from Lordstown Motors to Faraday Future.

But Slate’s emergence signals that the EV industry knows what’s at stake: if price and practicality aren’t addressed, EV adoption will plateau.

Conclusion and Outlook

The cooling of American consumer sentiment isn’t rejection, it’s a recalibration. Buyers are signaling that EVs must match internal combustion vehicles on price, convenience, and reliability before they’ll go mainstream.

The industry’s path forward is clear: continue investing in infrastructure, fix reliability issues, and deliver affordable models that appeal beyond early adopters. Europe and China offer a roadmap: when EVs are convenient and affordable, adoption surges.

U.S. consumers remain EV-curious, but not yet convinced. The next few years will determine whether that curiosity converts into widespread adoption, or whether America’s EV revolution pauses until those key barriers fall.

If automakers and policymakers can clear these hurdles, we may soon see a market where EVs thrive not because of policy nudges or idealism, but because they make sense for everyday Americans.