Luxury on the Line: How Affordability, Age, and Asia Are Rewriting Performance Prestige

For most of the past decade, Porsche has been the global auto industry’s profit outlier: Ferrari-like margins with far more volume, powered largely by SUVs that purists mocked and customers devoured. In 2025, the spell broke. As Oliver Blume, Porsche’s CEO, stated bluntly: “The business model that worked well for several decades no longer functions in its current form.”

So what happened to the most profitable big-volume luxury carmaker on earth, and what part of this story is about strategy, what part is macroeconomics, and what has to change?

The Numbers Behind the Wobble

Let’s anchor on the facts. In H1 2025:

Revenue fell to €18.2B (previous year: €19.5B); Operating profit fell to €1.0B (down 67% YoY from €3.1B); Operating margin: collapsed to 5.5% (from 15.7% a year earlier). Porsche Newsroom

Porsche cut its outlook again. Analysts now expect a full-year margin in the 5–7% range, depending on tariffs and price actions. Reuters

The company said U.S. import tariffs alone cost about €400 million in H1, and it expects a “high three-digit million euro” full-year hit even after an EU-U.S. deal lowered new tariffs to 15% (from a threatened 25%; pre-trade war, they were 2.5%). Porsche has raised U.S. prices to offset.

Deliveries fell 6% to 146,391, with China down 28% year-over-year in H1. ReutersMarketScreener

1) Porsche: From Profit Paragon to Pressure Test

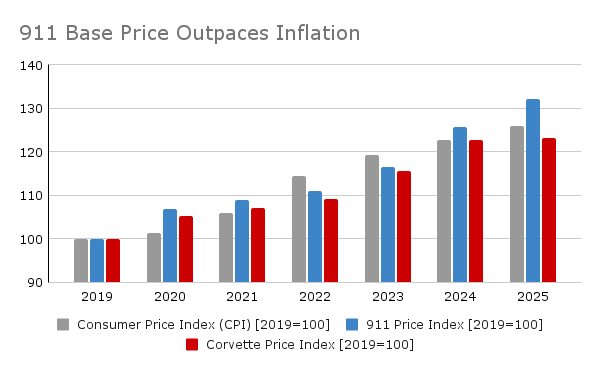

Porsche spent the last half-decade doing what most luxury brands only daydream about: raising prices faster than inflation while mostly climbing on volume. The 911’s base tag sprints from ~$92,350 in 2019 to $122,095 in 2025 (according to Car and Driver), outpacing CPI (BLS) by roughly 6 points, a gold-medal gap in a rate-heavy world.

Source: Car and Driver; BLS CPI

Translation: Porsche’s pricing power is still prodigious, but holding price and pace at the same time gets harder when money is expensive and you’re overly reliant on a region with less brand loyalty (Chinese sales were down 28% for 2024). The brand isn’t broken, it’s just discovering the limits of “charge more, sell more” in a market that now expects value density along with the badge.

So what? In a high-rate world, that extra spread matters. It nudges more would-be buyers into used/CPO or value alternatives (like the Corvette we show here), and it shifts new-car demand toward older, wealthier cohorts who are less payment-sensitive, but also offer less lifetime value. Meanwhile the delivery staircase goes up (mostly), then a squeaky step in 2024 (–3% YoY) as China wobbled and the global tailwind eased.

Source: Porsche Newsroom

What’s underneath the 2024 wobble? Region mix. Porsche itself flagged China as a drag (deliveries there were down 28% in 2024), which offset strength elsewhere and pulled the global total down despite the brand’s breadth.

2) Affordability Reframed: Who Can Actually Buy the Halo?

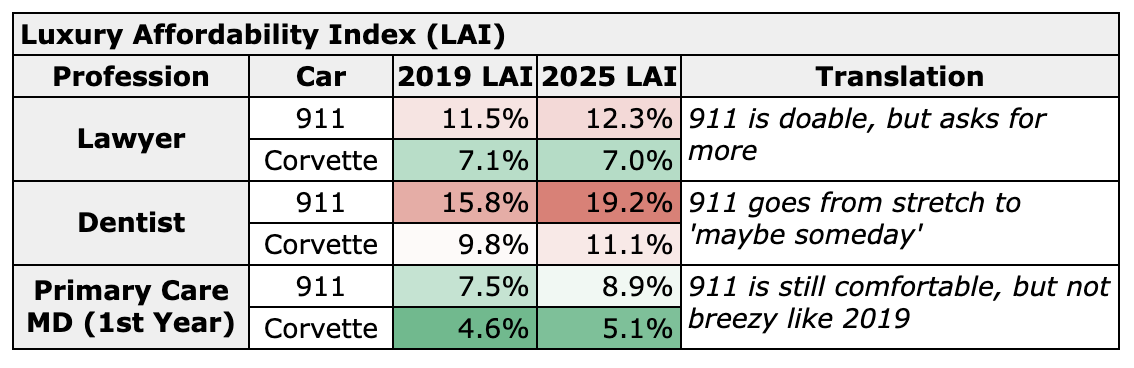

The stereotype is that Porsche 911’s are the classic first year purchase for Lawyers, Doctors and Dentists. But is that still true? Meet the Luxury Affordability Index (LAI); a simple gut-check:

LAI = monthly payment / monthly income

We built it with real-world(ish) assumptions (10–15% down, 60-month term, average new-car APR each year). Think of LAI bands like this:

≤ 10% — “Feels fine.”

10–15% — “Stretch, but doable.”

15–20% — “Love hurts.”

> 20% — “Just look at the poster.”

What the numbers say (2019 ➜ 2025):

In 2019 the base 911 was a stretch for many first-time buyers. In 2025 it’s a power yoga class. This also isn’t accounting for additional factors like auto insurance which has risen 26% YoY into 2025 according to Bankrate, widening the monthly gap. We also want to note this story is as much about wage stagnation (especially for dentists) as it is rising prices, but that’s a story for another post.

Why this matters: when rates are sticky and MSRPs outrun CPI, the first-time halo buyer doesn’t disappear, they defect. Some go Certified Pre-Owned (CPO) / used 911, many go Corvette / AMG / M cars where the LAI stays under ~10–12%. Meanwhile, older, higher-income buyers (who finance less or not at all) keep Porsche’s order book warm. That’s how you end up with record U.S. 911 sales and a younger-buyer fade at the same time. Both can be true.

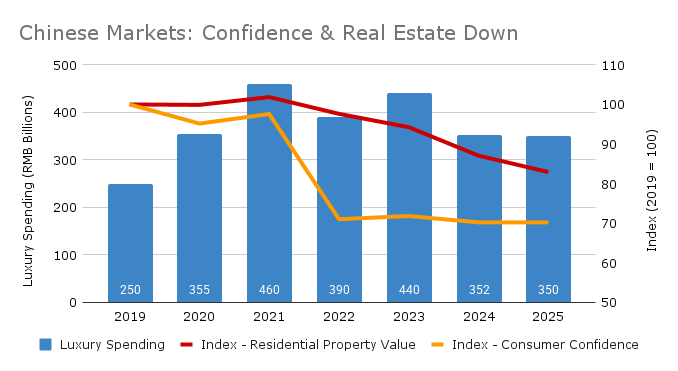

3) China’s Luxury Reset: Confidence Down, Competition Up

The US still had record 911 sales in 2024, but surely China continues to grow? Actually, no. China didn’t suddenly run out of money; it ran out of confidence, and customers found cheaper, tech-dense alternatives. Porsche’s own receipts tell the story: 2024 China deliveries fell 28% to 56,887 units, and 1H 2025 was again down 28% YoY in China even as Porsche kept a “value-oriented” sales stance.

Three headwinds:

Mood, not income. Per-capita disposable income actually rose in 2024 to ¥41,314 (nominal +5.3%, real +5.1%), but the consumer-confidence index hovered around ~88 (well below its long-run ~109 average). When big-ticket confidence is shaky, luxury purchases drop for all but the most convicted and well-healed buyers.

Wealth effect reversed. Housing is the household piggy bank, and home prices slid into late-2024 (major-city prices down 8.6% YoY on one composite), dulling the splurge impulse that used to power luxury imports.

A brutal price war + local luxury. Tesla’s 2024 cuts reinforced a deal-waiting culture, while domestic brands (BYD/Yangwang, Li Auto, NIO) piled in with feature-rich SUVs at aggressive prices. Li Auto alone reported blistering delivery growth into late 2024. EY’s latest luxury report shows that China luxury purchases are more likely to be status driven (vs quality or reward driven). Net result: import badges must now beat “value density,” not just history.

Why this hits Porsche specifically:

Region mix: China went from wind at the back to a parachute; Porsche flagged “challenging luxury conditions” and “intense competition” in 2025 updates.

EV positioning: Silent speed is no longer scarce. To win Macan EV/Taycan consideration, Porsche must over-deliver on software, charging, and spec content—the exact areas where local players are loudest. (Tesla’s price cuts didn’t help perceived value for any premium EV.)

4) Porsche’s Global EV Woes: Delays, Demand, and the Value Problem

Delayed Gratification. Porsche’s EV arc opened with a stumble: the Macan Electric was pushed back while Volkswagen’s software arm (CARIAD) struggled to deliver the E3 1.2 stack that underpins both the Macan EV and Audi Q6 e-tron. Public guidance and reporting in late-2022/23 cited the slip to 2024 and further schedule pressure tied to the software program. That lost year really matters, it gave rivals time to sharpen price, range and features while Porsche’s halo crossover waited in the wings.

Demand Contraction. When Porsche finally tallied 2024, it admitted two things at once: (1) global deliveries fell 3% to 310,718, and (2) Taycan shipments collapsed 49% to 20,836. This was blamed partly on a model changeover, but also on an EV ramp “proceeding more slowly than planned.” That’s Porsche-speak for ‘Oh Scheiße!’.

The premium EV squeeze. Even as global EV sales kept growing in 2024 (the IEA pegs them at 17 million, +25% YoY), growth is uneven by region and brutally price-disciplined. In the U.S., EV share is hovering around ~10% in 2025; buyers are laser-focused on monthly payment and perceived value. In that environment, a premium EV has to over-deliver on software, charging, and in-car tech to justify high MSRPs. Porsche’s own 2025 updates concede this: electrified share is rising (H1 2025 23.5% BEV, 36.1% electrified), but the company is also realigning product strategy and booking ~€3.1bn in extraordinary expenses as it rebalances its EV/ICE/hybrid mix.

The value optics. The Macan EV launches with premium pricing against feature-dense rivals; the badge has to carry more weight than ever. It has competitive 800V charging and top-tier performance, but it’s in a segment where rivals are cheaper and tech-heavier on paper. On top of that their base model Macan EV is almost $15k more expensive than the base model internal-combustion Macan. You can read more about the struggles of EV’s in the US market here.

Translation: the market is forcing Porsche to be pickier about where and how fast it goes electric.

How Porsche Can Turn Things Around

Stabilize value perception → Over-deliver on standard spec (audio/ range/ charge/ driver assistance (ADAS)/ etc) at entry trims; use curated ‘must-have’ options packs instead of expensive ladders.

Lean into hybrids as the empathy bridge → Customers are saying they want the Porsche feel but with better efficiency. Doubling down on 911 Hybrid and Panamera/ Cayenne hybrids buys time and keeps the driving experience intact while the market catches up and regulations still allow combustion.

Make EVs feel like Porsches → Chassis tuning and tactility first; software polish second; performance numbers third.

Simplify complexity → Cut option sprawl by 30–40% on EVs; make the sweet-spot obvious.

Tariff hedges → Evaluate limited North American assembly/ finishing for SUVs if tariff regimes persist.

Dealer carrots → Dealers can help incentivize first-time buyers with rate buydowns and low-APR captive offers that target LAI ≤ 10–12% for entry trims, etc. Push CPO for gateway buyers.

What I Will Be Watching

KPIs to watch:

Days Inventory Outstanding (DIO) / Cash Conversion Cycle (CCC): Are they moving cars or not?

Net Liquidity: How much cash do they have, are they able to cover short-term bills?

Debt to Capitalization Ratio: How leveraged are they?

China Mix: Is China improving or not?

EV Take-rates: Are they delivering on their EV future?

Lining Up the Next Shot

Porsche still owns the apex. The question is everything before it: confidence on entry, tariff bumps mid-corner, a value check on exit. The magic is intact; the price of admission just got noisier.

Tighten the line. Add grip where buyers feel it (spec, software, finance). Then let the steering do what only Porsche steering can do. Keep the feel, fix the deal.